Next Stop, Bordeaux?

Three decades since it started serving three capitals, could the Channel Tunnel finally be getting new destinations?

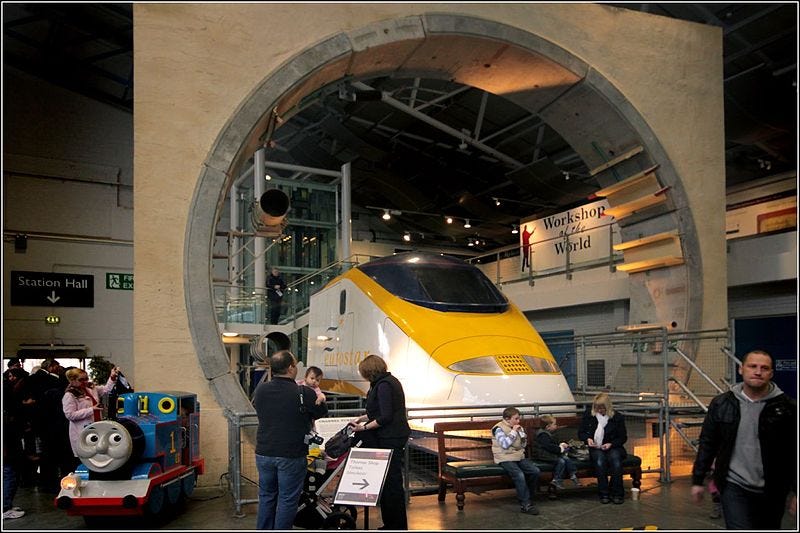

It was November 1994 when the first Eurostar service from London crawled out of the international terminal at Waterloo station bound for Paris.

It was the culmination of decades of planning, goodwill, and collaboration between French and British Governments, and their private sector partners. The project to build the Channel Tunnel was ambitious; even today it holds the record for crossing the widest stretch of water.

The ambition didn’t stop there. Such was the hope for its transformational capabilities that the British and French Governments had included plans for a second tunnel in the contract for Eurotunnel (now known as GetLink). At the turn of the millennium, they published a report on a potential second tunnel to be used for either a two-deck road, or if rail freight picked up, then for rail1.

This train terminates here

That second tunnel was never needed. Eurostar may have transformed journeys between London and its closest international neighbours, taking 80% of the passenger market to Paris, but its passenger forecasts never quite met expectations. What was originally envisioned as a pan-Western European network of routes connecting major British cities with their European counterparts never became more than two shuttle services between London and the capital cities of our Channel neighbours.

In some ways, the ambition for a network was dead before it had even started. An early design that envisioned a huge new underground through station at Kings’ Cross to allow Eurostar services to head onwards to Birmingham and Manchester was never realised, the Government instead opting for the terminal that now sits in St Pancras. History often repeats itself2.

Before the Covid-19 pandemic upended international travel, several attempts to launch new connections beyond the original routes to Paris and Brussels were made, but only the extension of Brussels services to Amsterdam came to fruition - in 2018. Eurostar’s plan from 2016 to launch a service to Bordeaux never took off.

Nor did long-running attempts by Deutsche Bahn (DB), the German state rail operator, to run services between London, Cologne, and Frankfurt from 2013, though they did run one of their trains to London to promote the cause in 2010. They had a little help though, as due to the lack of a train at the time that could interoperate between German, French, and British rail systems, the train was towed whilst in the UK.

Despite attempts to increase the journey opportunities, fewer stations are actually served today from Chunnel3 trains than just a few years ago. As part of its response to the pandemic, Eurostar closed down its operations at Ebbsfleet and Ashford stations in Kent leaving all services from London to run fast until they reach the continent. Reopening these, Eurostar believes, would not be economical4.

Light at the end of the Chunnel

Three decades on from that first service, the Chunnel still has plenty of space for additional trains. Around twelve trains per hour pass under the English Channel each way: mostly LeShuttle services carrying lorries, coaches and cars; the remainder are Eurostar and the occasional freight train. Another four international rail services could potentially be run each way, every hour.

Several companies have come forward over the past year eyeing up those slots; potentially to compete with the Eurostar monopoly, but also to open up new routes in their own right. Start-ups, from Spain and the Netherlands, and a British one, headed up by Richard Branson’s Virgin Group, have all expressed an interest in launching services, with at least one making moves to secure contracts for trains. DB is also said to be ‘still interested’.

An expansion of services and operators can only be a good thing. Competition on other international routes in Europe has seen prices come down and total passenger numbers increase5. And with the aviation industry’s transition to Net Zero yet to take off, efforts to reduce travel emissions between the UK and the continent will be reliant on some journeys moving to rail. An increase in total services may also bring prices down by reducing the marginal cost of infrastructure6.

The threat of competition is already spurring Eurostar to get ahead of any entrants, with an order of 50 trains to expand their fleet7. But such is the complexity of any operation that incumbent or upstart, there are a few hoops to jump through before launching a new route.

So you want to run a new Chunnel rail service…

Firstly, there needs to be spare capacity on the track for any new service to run. This is something that the respective owners of the Chunnel, and the line to and including St Pancras International station have been working on. Both are extremely keen to see their spare capacity utilised, with a monetary incentive to back it up of increased revenue and diversified risk away from the Eurostar monopoly. The main limit to capacity is not the track but the terminus in London. Any recent visitor to St Pancras will know how busy it can be when trains depart in (relatively) quick succession.

With its current layout, the station can handle 1,500 people every hour. With 900 seats on the typical Eurostar train, even at two trains per hour, the lounges, customs, and immigration desks can be extremely crowded. It’s for this reason that the station owner has commissioned plans to build out the lounges and check-in facilities to handle up to 5,000.

There is a second London terminal available to a more innovative market entrant that wanted to avoid the St Pancras bottleneck. Stratford International station in the east of the city was built to serve international services in advance of the 2012 Olympics though was never fitted out to do so8. A discount operator might want to put the ‘International’ in the station name to actual use.

Pending station overhauls then, you can run your train, but you need to have a train. Due to needing to operate across multiple national rail systems, each with their own signalling and electrification systems, chunnel-capable trains are neither cheap nor common. The difficulty of getting regulatory approval for trains is something that the infrastructure operators are acutely aware of, with several moves made in recent years to simplify clearance. However, just two train classes are currently cleared for service, all units of which are owned by Eurostar. Though never used for it, the newer of the two, the e320 which has been in operation since 2015, was built with the capability to use German electrification. If DB wanted to re-run their test train, they’d now be able to travel the full route.

Trains also need sidings to park up in at night. For UK international services on High Speed 1 (HS1), these are located at Temple Mills Depot, currently operated by Eurostar. Though contracts require Eurostar to allow new market entrants access to the site if there is capacity, in practice this may take several years of legal wrangling to prove that there is the space to do so. Should that fail, overcoming the challenges of building a new depot anywhere near HS1 is not going to be easy.

…to where?

The biggest question of all though, is where to send the trains once they reach Europe. The destination needs to be popular, but it also needs to be possible. Popular means a big city, or several of them, that can be reached in around five hours. Longer than that, and the rail service won’t be competitive with air travel.

Possible means having a destination station with the capacity to stable a train, but also the space to house all of the customs, immigration, and lounge space necessitated by international services. This is a difficult task, as the recently completed overhaul of Amsterdam station showed. It will also require international government cooperation to agree juxtaposed border controls9, and the funding to operate them.

Here are a few of the most likely options, with an arbitrary score from yours truly.

Bordeaux

Metro Area Population: 1.3m, Approximate Journey Time: <5 hours, Score 8/10

Of any new Chunnel route, this is perhaps the most likely to succeed. The infrastructure operators on the end-to-end route have been working together for several years to make this a reality, and any new services will make the most of the brand new high speed line that opened in 2017 delivering passengers to the Atlantic French coast in under five hours. It’s also a route that Eurostar has long been keen on, and with the company now firmly under French control, is likely the highest priority for any new route. I’m giving it an 8/10 on the basis I think the most likely first additional service will be competition on an existing route.

Marseille

Pop 1.8m, Time <6 hours, Score 5/10.

Eurostar has some experience running to Marseille, albeit with now cancelled services formerly under the ‘Thalys Sun’ brand that ran from Brussels. One presumes that if they’re struggling to run direct summer services from Brussels, then London will also be a challenge. Though a longer journey time than for Bordeaux, the larger population and greater pull of the French riviera might still be appealing for operators.

Rhine-Ruhr (Cologne and Dusseldorf)

Pop 11m, <4 hours, Score 6/10

Any service to a city in this megaregion will connect in with the dense rail network of the Rhine and Ruhr valleys. DB’s original plan was for services from London to split at Cologne before heading on to Dusseldorf and Frankfurt. However, services to Germany are more challenging to launch as they’ll require additional trains to be built, as well as new international agreements on customs and border control. Eurostar potentially has a head start on this route, as it already serves the region, albeit via continental only services. Given DB’s long-term interest in the route (even if not acted upon), one suspects that their stations will have the space for any upgrade.

Frankfurt

Pop 5.6m, Time <5 hours, Score 6/10.

A longer journey than to Cologne, but it comes with the benefit of connecting the European banking hub to London, and tapping into a large network of business travellers. If a route to Cologne goes ahead, it’s highly likely that this will be an extended or sister service.

Geneva

Pop 600k, Time <6 hours, Score 3/10

Travellers between London and Geneva generally fall into two categories. The first, business travellers, are unlikely to make the journey by train. The flight time is only 90 minutes, and though air travel comes with the challenge of traipsing through an airport, business travellers flying from London City have a terminal time closer to 20 minutes than the usual two hours. The route might however be attractive to the large and lucrative winter leisure market. Stowing winter sports equipment on the train seems far easier than hauling it to, from, and through airports, and having to collect it from the oversized baggage carousel. Some potential then for a seasonal service, but given the similar challenges to Germany of network interoperability and international agreements, it’s unlikely.

Zurich

Pop 1.6m, Time, <7 hours, Score 1/10

Though rumoured as a potential route, a journey as long as this is unlikely to be competitive with air travel, and will be uneconomic for operators given the investment required for potentially only one or two services per day. For the same reason, we’re unlikely to see any services to cities further afield such as Milan.

Departing in 2028?

There are no easy decisions when it comes to launching an international rail service. Even with the best financial and corporate backing, it will likely take years of wrangling before any trains leave the station. Governments need to negotiate treaties, trains need to be manufactured, and stations need to be upgraded. A three year timeline seems reasonable, so if we’re lucky, we might see services to destinations new by 2028. I’m channeling all the hope I can.

The most astounding thing about the proposal was that it was predicted to cost just £2.7bn, a bargain compared to British infrastructure costs today.

I have to agree with them, lengthening journeys to a city of ten million to benefit communities a hundredth of the size is not a sensible trade-off

https://www.railway-technology.com/features/how-spain-became-the-arena-for-high-speed-rail-competition/

An increase in trains may support further fee reductions for trains by spreading the relatively fixed maintenance and operating cost across more passengers. GetLink charges Eurostar approximately £25 per passenger to use the Chunnel today.

Whether these are used for services to London is another matter. Following their merger with Thalys, Eurostar no longer exclusively provides cross-channel services.

In practice, this would involve trains arriving and departing from separate platforms, but travelling on to St Pancras to turn around, potentially with alighting only.

Unlike with travel by sea and air, immigration on all Chunnel services is carried out before boarding. This requires international treaties to permit border controls and respective jurisdictions overseas.

I would LOVE to get to Bordeaux on one train ~ I tried it last year and had a nightmare when metro strikes meant I nearly missed the connection :/ Absolutely destroyed the colin the caterpillar cake I was taking to my French friend

Eurostar did run a direct service from St Pancras to Marseille for a few years from 2015-2020 so I think this deserves a higher score!

I took it once and the outbound journey was great six hours from London to the Med! The return was a pain because of the mandatory de-training/re-boarding at Lille for customs and immigration.